This blog is mainly centred around achieving financial independence, ditching the 9-5 grind and potentially retiring. However, I don’t quite like the word “retire” because it’s mainly associated with lazing around doing nothing – and while this may sound like the ideal retirement for some – others may prefer to work. In that sense, the financial independence retire early (or FIRE for short) movement has received a fair bit of criticism – mainly from people angrily waving their fists in the air and pontificating “what would you do with all that time?!?” as well as “well I love my job so why would I want to retire and laze around all day doing nothing?!!”.

Disclaimer: The content of this blog article is not investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. Please consult a registered financial advisor to assess the aforementioned.

Well these people have a point, I believe these exclamations stem from the traditional view of retirement and the word “retirement” being a constituent of the FIRE acronym. Instead, I prefer to view the FIRE movement as a movement with the end goal being “work optional” – i.e. choosing to work and not needing to. In other words, being able to have the freedom to walk away from a job with no financial repercussions. Anyway, enough with the definitions and personal categorisation, let’s dig into the numbers!

Early retirement is a great way to maximize savings and live a comfortable life

To be annoyingly redundant – if you want to retire (early or otherwise), you have to save and invest. There are no ifs, ands or buts about it. That’s why proponents of the FIRE movement are radical about throwing huge chunks of their income toward their retirement – and by huge chunks I mean over 50% of their income!

Since salary income is the most powerful (and traditional) wealth-building tool, FIRE movement devotees get creative about finding ways to make extra cash such as:

- Increasing income through aggressive pay raises like changing jobs every 2 years, or by being in sectors which are high paying (this isn’t a necessity though – I will get to this later);

- Side hustles or a second job; and

- House-hacking e.g. taking a mortgage out on a multi-unit and renting out the other unit(s) to fund the mortgage payment completely – effectively living rent free.

Okay, now that we’ve established the tools to increase savings, how much do you actually need to save and invest? Well, if you have read some of the other articles on this blog, covering my estimates of retirement account size in various countries around the world – this answer should be quite straightforward. However, the real question is how and when do you get to retire?

Breaking down the FIRE movement and estimating how many years until you can retire

Firstly, congratulations on making it this far – there’s a lot to absorb in this article. Secondly, the amount of time it takes to retire is more dependent on your savings rate than your income. Let me distil this with a hypothetical case study – let’s assume Zoey earns $40K per year as a receptionist and Francisco earns $400k per year as a tech CEO. Zoey saves approximately $20k per year while Francisco saves $200k per year. My question is, who would retire sooner? The answer may be difficult to believe but both Zoey and Francisco would retire in the same amount of time since they both have a 50% savings rate (Zoey = $20k/$40k = 50% and Francisco = $200k/$400k = 50%). Although Francisco earns more, he spends more, meaning he saves (proportionally) the same as Zoey. This is why the savings rate is more critical than income !!

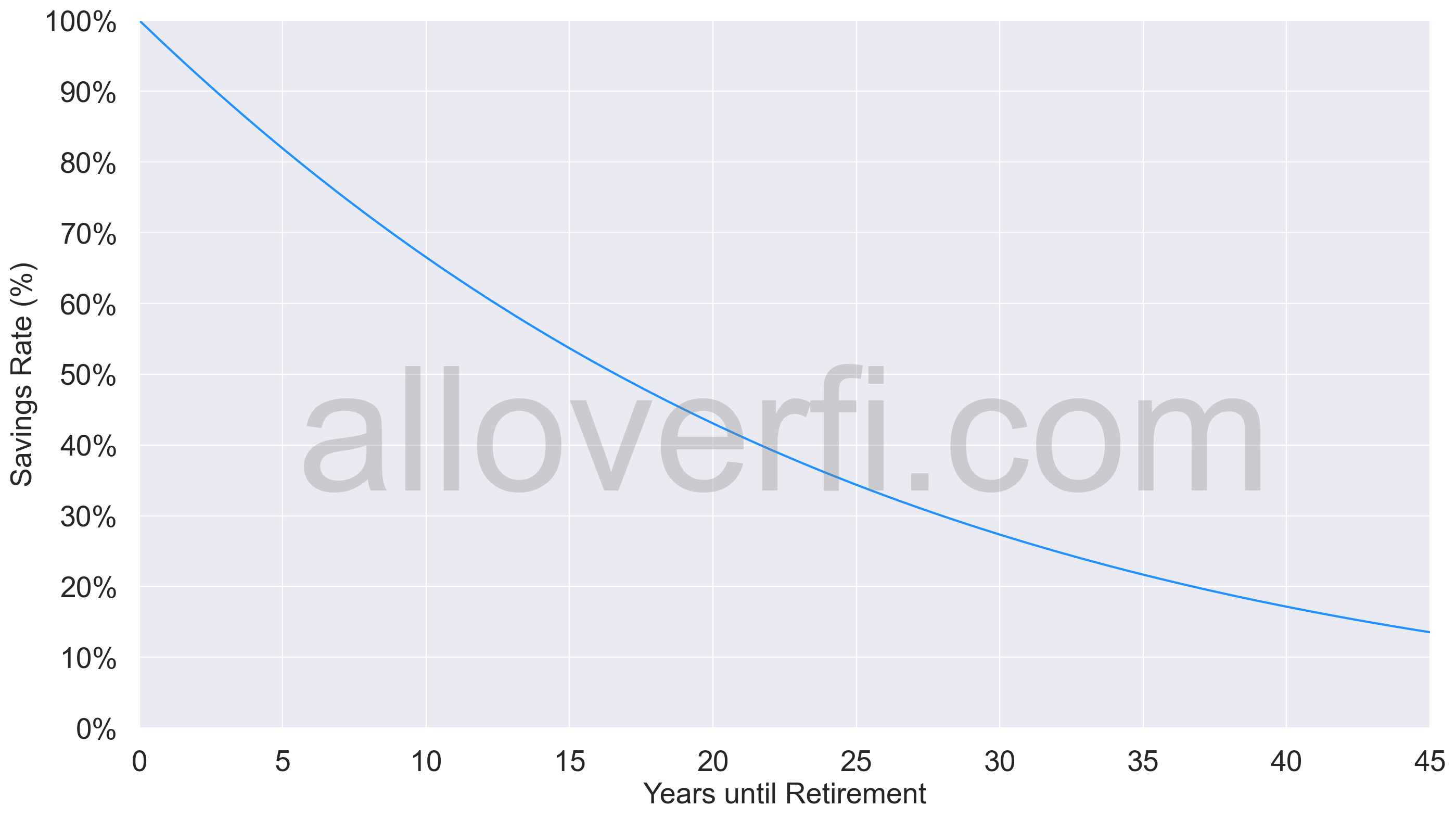

If this still sounds unbelievable, allow me to illustrate this further – I constructed a graph (below) showing the relationship between savings rate and the number of years to retirement. In addition, I added the investment rate of return i.e. assuming that savings are invested in some investment account (stocks, bonds, crypto, index funds etc.). I made some assumptions to generate this graph such as:

- A retirement safe withdrawal rate of 4% which is derived from the Trinity study;

- Your current expenses are equal to your expenses in retirement;

- A 5% annual return on investment (inflation adjusted); and

- No savings on day one.

From the graph above, to retire in:

- 5 years you would need a savings rate of approximately 82%;

- 10 years you would need a savings rate of approximately 66.5%;

- 15 years you would need a savings rate of approximately 53.7%;

- 20 years you would need a savings rate of approximately 43%.

Now that that’s out of the way, you may probably realise why FIRE movement devotees save a large chunk of their income. To retire early, you need a reasonably high savings rate and a frugal lifestyle. Retiring early is less dependent on your income level (but having more money definitely helps !!).

If you would like to read more about the 4% rule and FIRE you may check out the MMM blog post here.