I bet at some point, whether recently or some period in your life, you envisioned retirement as the final destination where you would never have to work, basking in the memories of your golden years while squinting at a not-so-distant ocean view. While dreamy, this idea of retirement is mostly qualitative in nature – meaning most people don’t have an idea of the cost of this picturesque retirement. Okay, maybe they have some inflated sense of the retirement costs – maybe $1 million or $5 million in savings? However, the real cost of retirement could be significantly less than this range – so much so that you may realise that you may be closer (geographically or otherwise) to retirement than you think..

Disclaimer: The content of this blog article is not investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. Please consult a registered financial advisor to assess the aforementioned.

This article is one of a series of articles investigating the cost of retirement in various countries/cities around the world. Whether you live in the city you’re planning to retire in or you’re exploring an expat retirement, my hope is that this series of articles inspires you to view retirement not as one big number, but instead as a series of retirement options from which you can plan your ideal retirement – and who knows, maybe you’ll land that dreamy beach view a lot sooner than you think!

This article breaks down retirement in Niger and is based on the estimation of the cost of living (or lifestyle costs) which can vary considerably between Niamey and smaller cities. To get around this issue, the numbers presented in this article refer to the average or typical lifestyle costs in Niger. With that out of the way, buckle in because you’re about to be hit with some hard numbers!!

Expenses and Cost of Living in Niger

While this may sound painfully obvious, expenses and lifestyle maintenance significantly affect your retirement. Therefore, before we can address how much money you’d need to retire in Niger, we have to quantify expenses.

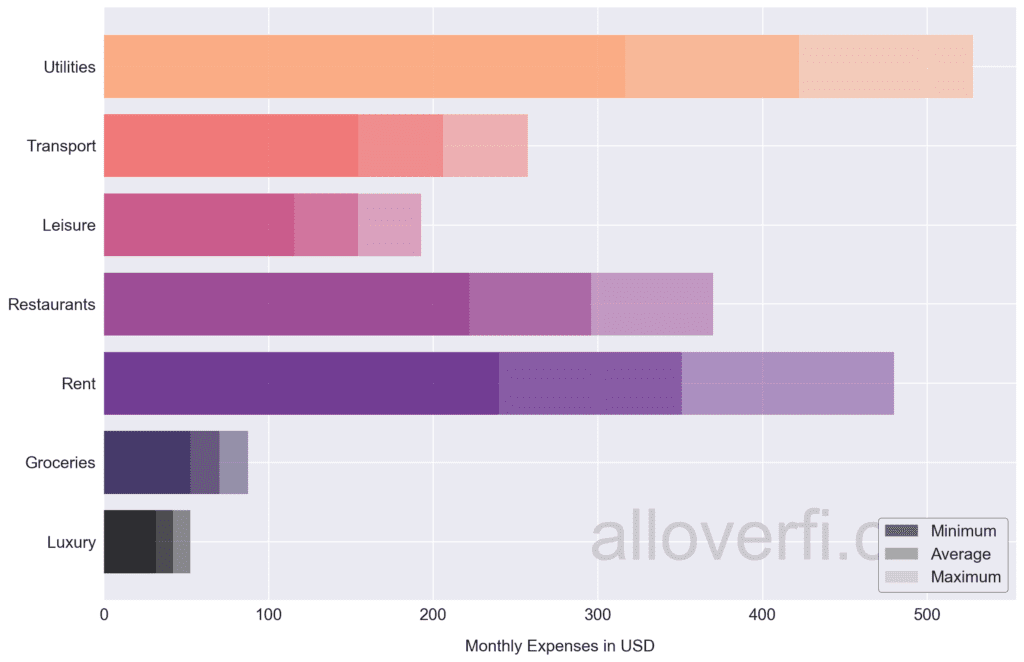

For the calculation of monthly expenses, a detailed model of a typical basket of goods was developed which was based on data from Numbeo.com. Numbeo is a collection of user-submitted data containing numerical and other itemizable data about cities and countries, designed to enable crowdsourcing of expenses. In less words, Numbeo is like the Wikipedia of expenses. The core monthly expense categories in the model comprise of the following:

- Transportation – it was assumed that transportation would be private i.e. comprising of fuel and car payments. This was considered conservative as public transport should reduce expenses considerably;

- Housing – a single one bedroom apartment. Higher one bedroom apartment prices are considered in areas near or in the city center(s);

- Groceries are accounted for as a fraction of housing costs as it’s assumed that city centers (or other expensive areas) would command higher costs of living associated with local grocers as well as food delivery;

- Luxury items such as non-essential clothing items, electronics and impulse purchases;

- Utilities – water, refuse/garbage, electricity and internet costs;

- Restaurants – dining out; and

- Leisure activities – weekend activities and after work activities.

Okay enough with the word salad, let’s take a look at the data. The breakdown of expenses is best visualised as a bar plot as shown below.

From the bar chart above, the minimum and maximum estimates of expenses refer to the lower and upper bounds of a typical middle class lifestyle. The wide range in rent refers to location factors with the higher estimates referring to apartments closer to city centers. If you strongly feel any estimates are on the low or high side, please comment below and I will gladly incorporate your feedback into the expense model.

Overall, the average cost of living in Niger varies between $ 1,130 (minimum) to $ 1,970 (maximum) with the average cost of living being $ 1,540. While the total expense estimates are useful to comprehend in relative terms, it may be useful to visualise the breakdown of monthly expenses as a donut chart.

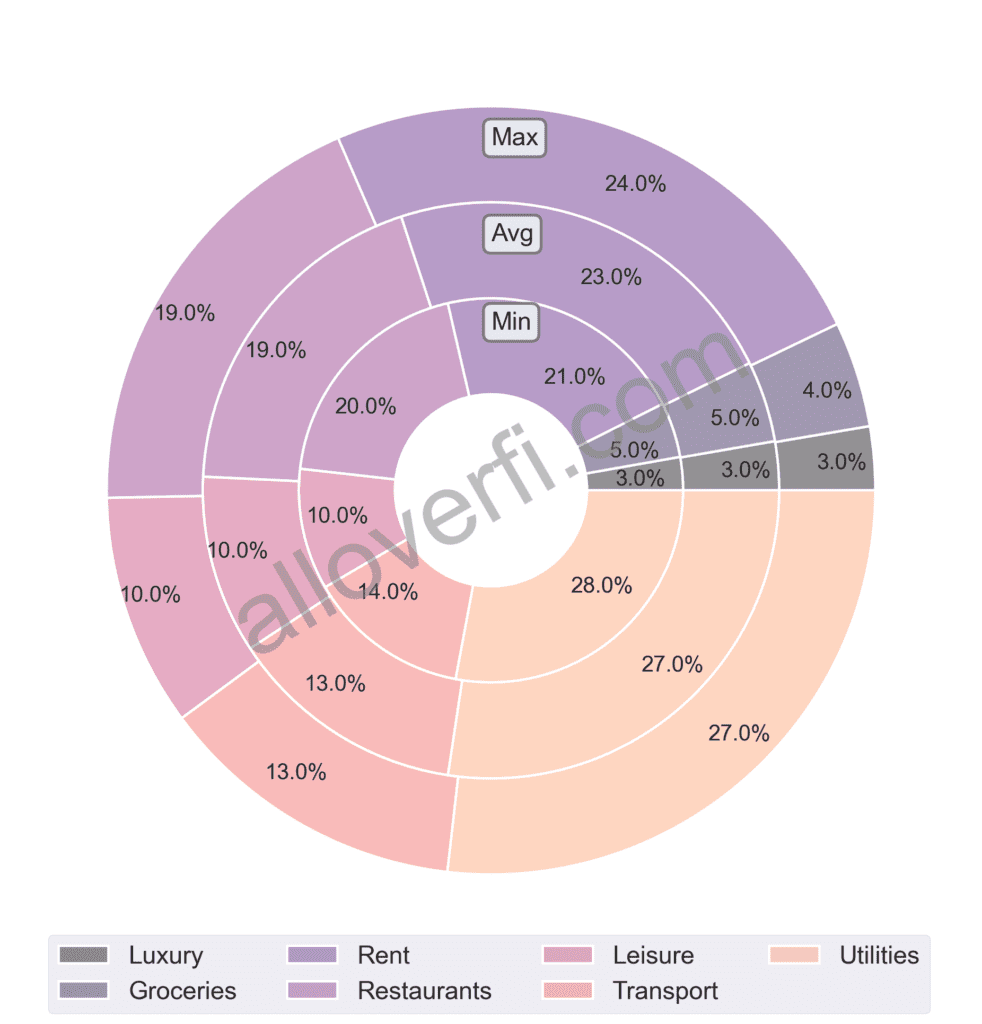

Monthly breakdown of expenses for the minimum, average and maximum expense scenarios

From the breakdown of expenses, rent is a significantly lower percentage of monthly expenses for the minimum scenario. This means that living further from the city center is not only cheaper in absolute terms but also relative to other monthly expenses.

Well, defining expenses was fun (for me at least), the major objective here was to estimate as best as possible what the cost of living is in Niger. If you’ve made it this far, then congratulations and you deserve a pat on the back because the next chapter ties everything together (mostly) in a neat bow.

Okay, how much money do I need to retire in Niger again?

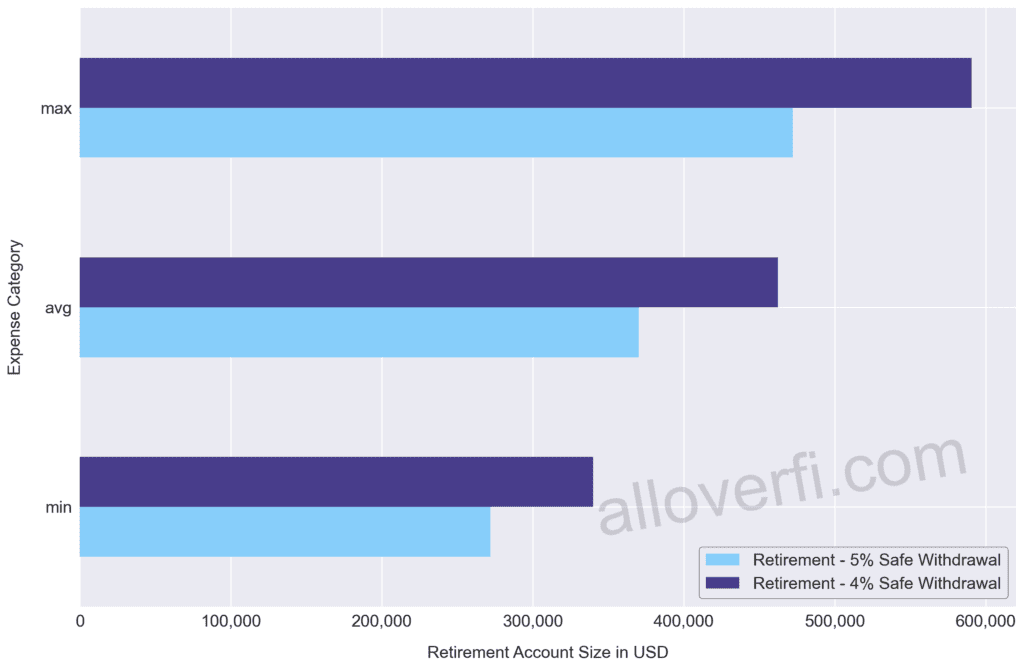

Before we dive head first into quantifying how much money you’ll need to retire in Niger, we need to cover a retirement rule (not really a rule by the way – more like a recommendation) that has been perpetuated since the dawn of personal finance – the 4% rule. Or rather the 4-5% rule (as I like to call it). The 4% rule is a rule of thumb that suggests retirees safely withdraw annual expenses up to 4 percent of their retirement account during every year of retirement. Many factors influence the safe withdrawal rate such as risk tolerance, tax rates and the tax status of your portfolio. The longer you live, the longer you’ll need your money to last. I use the term “retirement account” very, very loosely here – the retirement account described here could be any nest egg – such as a taxable brokerage account, a crypto account, index fund etc.

Safe withdrawal means withdrawing less than the retirement account is appreciating. For example, if a retirement account appreciates by 10% per year and you withdraw 4%, your account has still appreciated by 6%. Basically, safe withdrawal implies that you will be able to withdraw in perpetuity (basically foreverrr) without your account diminishing in size (in most scenarios your account would increase in size). I digress, to read more about the 4-5% rule, you may read my detailed write-up on the topic here.

By incorporating the 4-5% rule, it’s relatively straightforward to calculate how much money you’ll need to retire in Niger. In the table below I have summarised the retirement account size required based on monthly expenses and a safe withdrawal rate of 4% and 5%.

| Expense Scenarios | Monthly Expenses | Retirement 4% safe withdrawal per year | Retirement 5% safe withdrawal per year |

|---|---|---|---|

| Minimum | $ 1,130 | $ 339,900 | $ 271,900 |

| Average | $ 1,540 | $ 462,500 | $ 370,000 |

| Maximum | $ 1,970 | $ 590,600 | $ 472,400 |

Estimation of Retirement Account Size based on Safe Withdrawal Rate

From the results above, you can gauge the impact of lowering monthly expenses has on retirement account size. More specifically, by living modestly i.e. on $ 1,130/month (minimum expenses scenario) a retirement account size of $ 271,900 would be approximately 58% of what someone would need to retire with a more “luxurious” lifestyle ($ 472,400). This means that retirement could be reached much sooner. In fact, this very philosophy underpins the financial independence retire early (FIRE) movement which caters to people spending less, saving more and retiring much much earlier (like in-your-30s-early). To read more about this movement, you may read my detailed write-up here.

Okay so to summarise, to retire in Niger – you need between $ 271,900 and $ 590,600 depending on expenses (outlined above) and the preferred safe withdrawal rate.

The information and estimates described in this article are intended as a rough starting point. Other retirement expenses may be significant which were excluded due to their case-by-case complexity which you (the reader) should take into account such as:

- Home ownership costs;

- Medical insurance;

- Schooling costs;

- Repayment of existing loans; and

- The list goes on and on.