So here’s the deal, if you’re reading this article you’re probably thinking about a retirement where you can finally relax and reflect on your life. For some, retirement may mean spending more time with family and friends. Others might decide to travel the world or start their own business. Some people might just want to sit around all day watching Netflix! Whatever your plans for retirement may be, one thing is clear – you’ll need to save money for it! However, the big question is how much money do you need to retire? You’ve probably heard that you require in excess of $1 million or maybe that you could retire on much less out of state – which begs the question: “how much is much less?” To answer this question, I have estimated the retirement account size for over 70 cities in multiple States across the US (including Indianapolis)!

Disclaimer: The content of this blog article is not investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. Please consult a registered financial advisor to assess the aforementioned.

Whether you live in the State you’re planning to retire in or you’re exploring an out-of-state retirement, my hope is that this series of articles inspires you to view retirement not as one big number, but instead as a series of retirement options from which you can plan your ideal retirement – and who knows, maybe you’ll be able to binge watch Netflix 24/7 a lot sooner than you think! The numbers presented in this article refer to the average cost of living in Indianapolis, Indiana with the underlying objective of answering the question “How much money do I need to retire in Indianapolis?”. This article is structured as follows:

- Cost of living: transportation, housing, groceries and other monthly expenses;

- Distribution of expenses e.g. percentage breakdown of monthly expenses; and

- Sizing retirement account using the 4-5% rule.

Average cost of living in Indianapolis, Indiana

While this may sound painfully obvious, expenses and lifestyle maintenance significantly affect your retirement. Therefore, before we can address how much money you’d need to retire in Indianapolis, we have to quantify expenses.

For the calculation of monthly expenses, a detailed model of typical monthly was developed which was based on data from Numbeo.com. Numbeo is a collection of user-submitted data containing numerical and other itemizable data about cities and countries, designed to enable crowdsourcing of expenses. In less words, Numbeo is like the Wikipedia of expenses. The core monthly expense categories in the model comprise of the following:

- Transportation – it was assumed that transportation would be private i.e. comprising of fuel and car payments. This was considered conservative as public transport should reduce expenses considerably;

- Housing – a single one bedroom apartment. More expensive one bedroom apartments are considered in areas near or in city center(s);

- Groceries are accounted for as a fraction of housing costs as it’s assumed that city centers (or other expensive areas) would have higher costs of living;

- Other items such as non-essential clothing items, electronics and impulse purchases;

- Utilities – water, garbage, electricity and internet;

- Restaurants – dining out; and

- Leisure activities – weekend activities and after work activities.

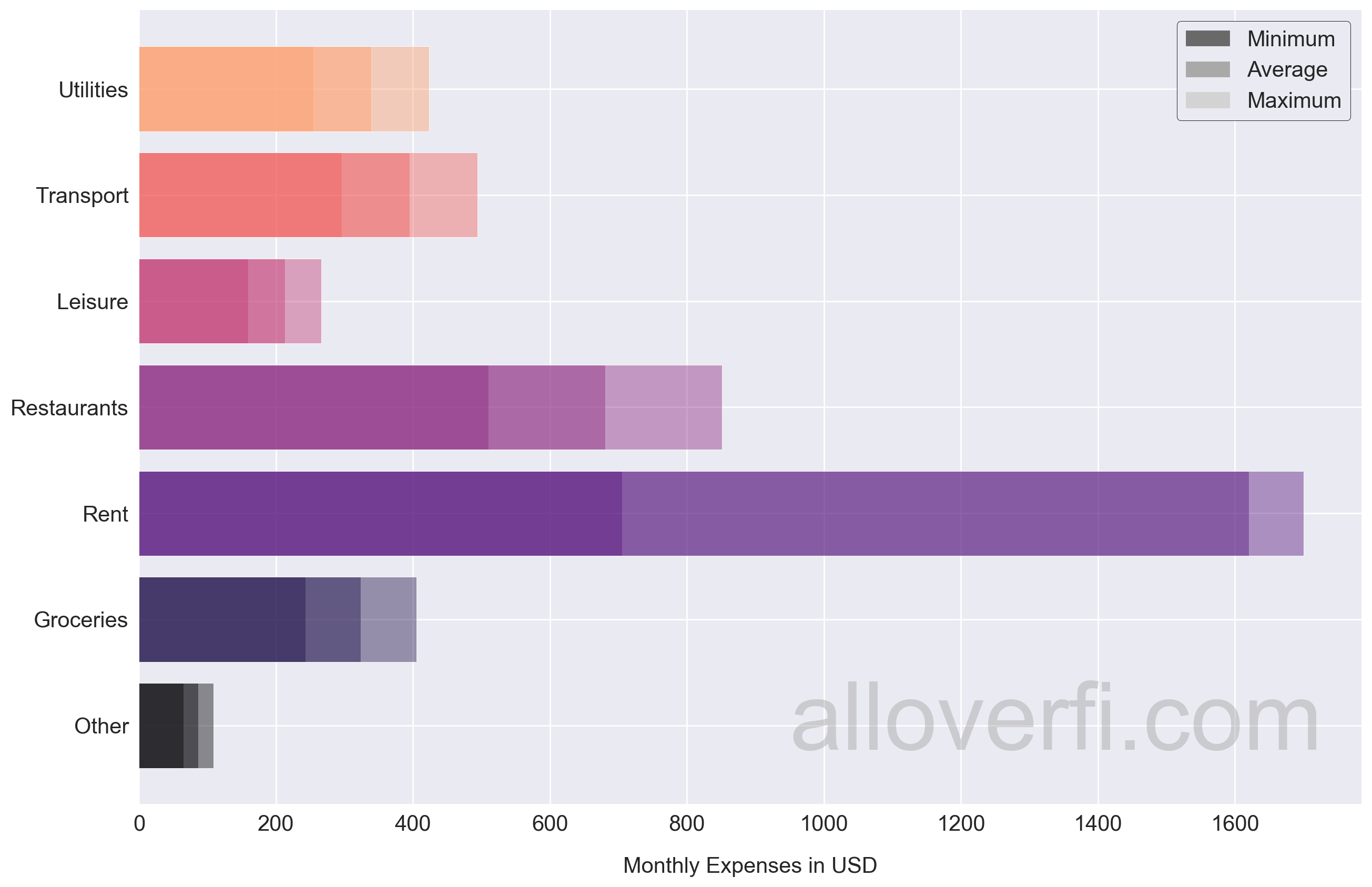

Okay enough with the word salad, let’s take a look at the data. The breakdown of expenses is best visualised as a bar plot as shown below.

From the bar chart above, the minimum and maximum estimates of expenses refer to the lower and upper bounds of a typical middle class lifestyle. The wide range in rent refers to location factors with the higher estimates referring to more centrally located apartments. If you feel any estimates are on the low or high side, please comment below and I will gladly incorporate your feedback into the expense model.

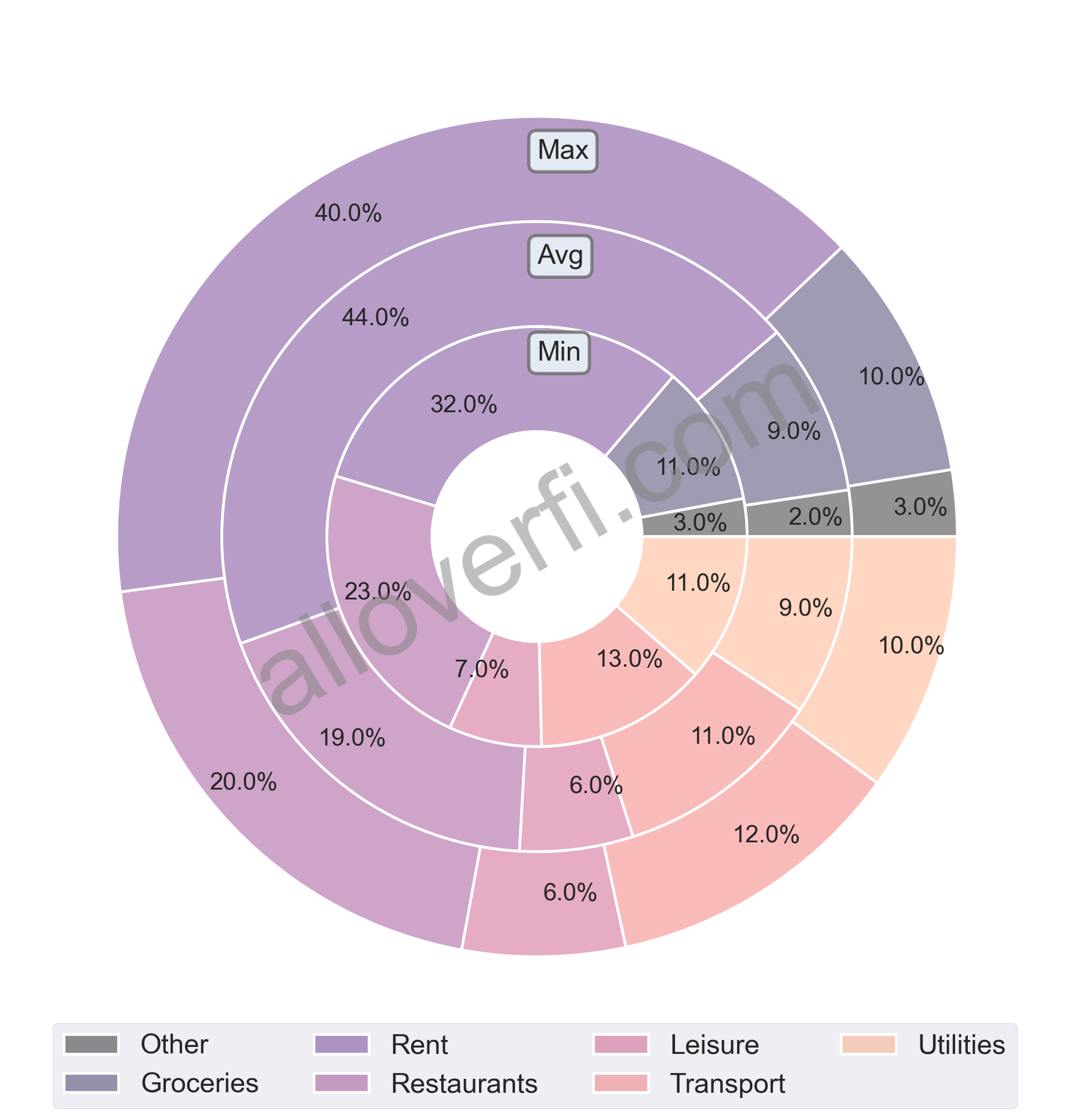

Overall, the average cost of living in Indianapolis varies between $ 2,230 (minimum) to $ 4,250 (maximum) with the average cost of living being $ 3,660. While the total expense estimates are useful to comprehend in relative terms, it may be useful to visualise the breakdown of monthly expenses as a donut chart.

From the breakdown of expenses, rent is a significantly lower percentage of monthly expenses for the minimum scenario. This means that living further from the city center is not only cheaper in absolute terms but also relative to other monthly expenses.

Okay, how much money do I need to retire in Indianapolis, Indiana again?

Before we dive head first into quantifying how much money you’ll need to retire in Indianapolis, we need to cover a retirement rule (not really a rule by the way – more like a recommendation) that has been perpetuated since the dawn of personal finance – the 4% rule. Or rather the 4-5% rule (as some like to call it). The 4% rule is a rule of thumb that suggests retirees can safely withdraw annual expenses up to 4 percent of their retirement account during the year they retire. Many factors influence the safe withdrawal rate such as risk tolerance, tax rates and the tax status of your portfolio. The longer you live, the longer you’ll need your money to last. I use the term “retirement account” very, very loosely here – the retirement account described here could be any nest egg – such as a taxable brokerage account, a crypto account, index fund etc.

Safe withdrawal means withdrawing less than the retirement account is appreciating. For example, if a retirement account appreciates by 10% per year and you withdraw 4%, your account has still appreciated by 6%. Basically, safe withdrawal implies that you will be able to withdraw in perpetuity (basically foreverrr) without your account diminishing in size (in most scenarios your account would increase in size). I digress, to read more about the 4-5% rule, you may read my detailed write-up on the topic here.

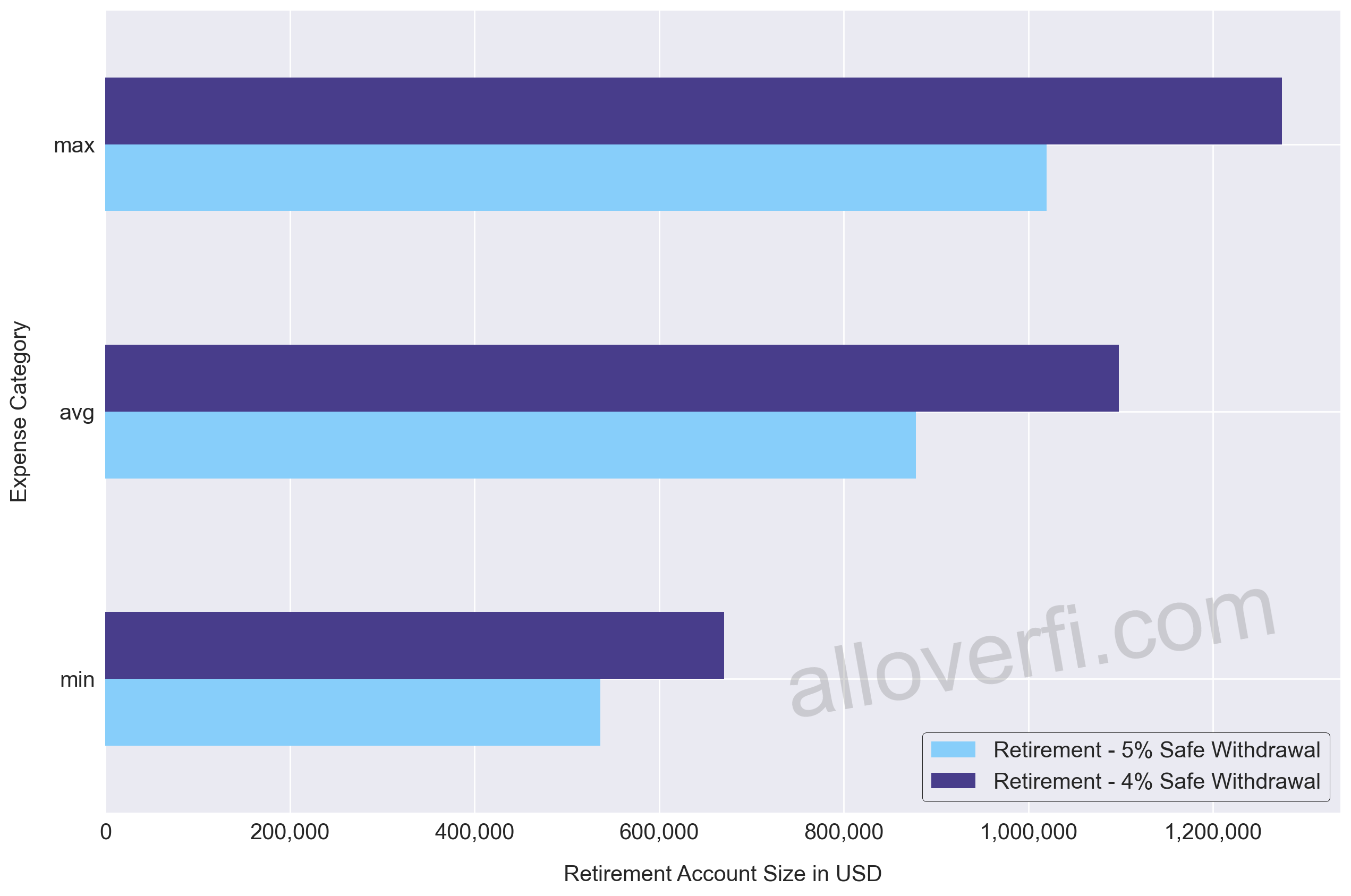

By incorporating the 4-5% rule, it’s relatively straightforward to calculate how much money you’ll need to retire in Indianapolis, Indiana. In the table below I have summarised the retirement account size required based on monthly expenses and a safe withdrawal rate of 4% and 5%.

| Expense Scenarios | Monthly Expenses | Retirement 4% safe withdrawal per year | Retirement 5% safe withdrawal per year |

|---|---|---|---|

| Minimum | $ 2,230 | $ 670,300 | $ 536,200 |

| Average | $ 3,660 | $ 1,097,800 | $ 878,300 |

| Maximum | $ 4,250 | $ 1,274,600 | $ 1,019,700 |

From the results above, you can gauge the impact that lowering monthly expenses has on the retirement account size. More specifically, by living modestly i.e. on $ 2,230/month (minimum expenses scenario) a retirement account size ($ 536,200) would be approximately 53% of what someone would need to retire with a more “luxurious” lifestyle ($ 1,019,700). This means that retirement could be reached much sooner. In fact, this very philosophy underpins the financial independence retire early (FIRE) movement. To read more about this movement, you may read my detailed write-up here.

Okay so in summary, to retire in Indianapolis, Indiana – you need between $ 536,200 and $ 1,274,600 depending on your expenses (outlined above) and your safe withdrawal rate.